Financial Information

For more information on the new Emerging Contaminants Remediation Surcharge, please click here or scroll down the page.

Budgets

Thurston PUD has two primary funds: Water and General.

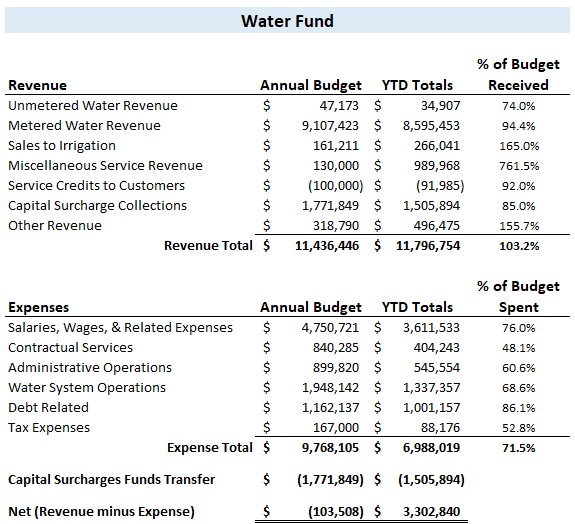

Water Fund

The Water Fund revenue

sources are rate revenue and interest income. Rate revenue is primarily

comprised of the base rate and consumption charges for residential,

commercial and irrigation use. Thurston PUD serves approximately 10,100

families, businesses, schools, and parks in five (5) counties: Thurston,

Pierce, Grays Harbor, Lewis, and King.

Thurston PUD uses water fund revenues to operate

and maintain 271 water systems, administrative and field operations

buildings and staff related expenses.

Below is a table reflecting the revenue and expenses for the current period.

Revenue and Expense Report

October 2025 YTD

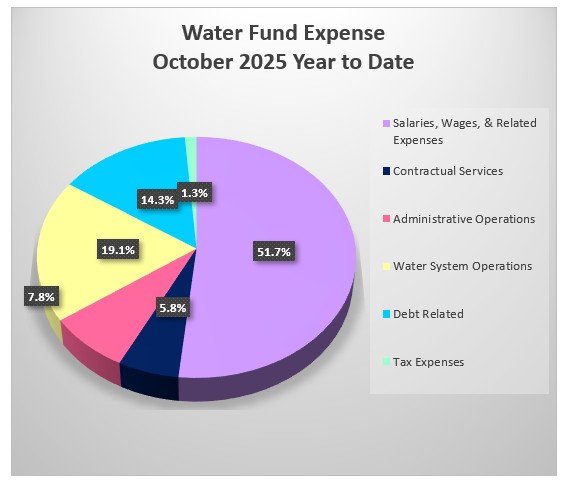

Below is a pie chart depicting the Water Fund Expenses for the current period.

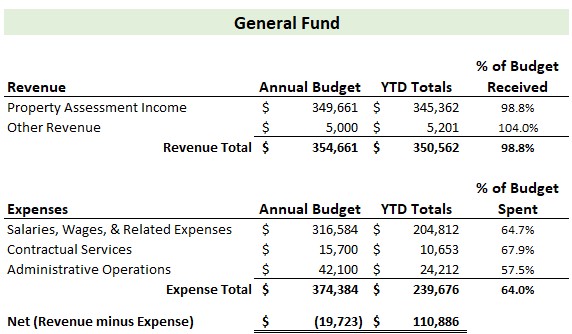

General Fund

The primary revenue source for the General Fund is property taxes

assessed for properties located in Thurston County. The 2025 property

tax rate for Thurston PUD is $0.005462476384 per $1,000 assessed value,

resulting in an estimated tax collection estimate of $346,387 in 2025.

At this tax rate, the owner of a $500,000 property will

pay $2.73 in property taxes to Thurston PUD in 2025. Also, the General

Fund yield interest on the cash balance reserves.

The primary use of the property taxes

Thurston PUD receives is to fund Board of Commissioners election costs,

salaries, and expenses. Additionally, the

General Fund pays a minimal allocation for operations and staff related

expenses.

Below is a table reflecting the revenue and expenses for the current period.

Revenue and Expense Report

October 2025 YTD

NEW! Emerging Contaminants Remediation Surcharge

In 2021, the Washington State Board of Health

adopted State Action Levels (SALs) for five newly regulated contaminates

called per- and polyfluoroalkyl substances (PFAS). PFAS are a large

family of human-made chemicals used to make stain resistant, water

resistant, and nonstick consumer products. A major source of PFAS in our

area is from firefighting foam used by the military, local fire

departments, and airports. PFAS in drinking water is a nationwide

problem.

Washington State develops SALs to protect the

health of drinking water consumers from contaminants that are not

federally regulated. The PFAS SALs are public health goals for lifetime

consumption of water, including by sensitive populations. When tap water

exceeds a SAL, the State Department of Health recommends that the water

system take action to bring the level below the SALs for long-term

drinking.

On April 10, 2024, the Environmental Protection

Agency (EPA) announced a final federal rule that newly regulates the

Maximum Contaminant Level (MCL) for six PFAS contaminants in drinking

water. The EPA PFAS Standards are expected to replace the Washington

State PFAS Standards when approved by the Washington State Board of

Health. Water systems must complete initial monitoring by 2027, inform

the public of results, and implement solutions to reduce PFAS if levels

exceed the limits by 2029.

The monitoring and remediation requirements for

PFAS set forth by DOH and EPA are specific to Group A water systems

only, which are defined as water systems with 15 or more water

connections. Group B water systems, which are defined as water system

with less than 15 water connections, are regulated by the local county

and currently do not have PFAS monitoring or remediation requirements.

Thurston PUD was an early implementor of PFAS

testing and identified the water systems that detect PFAS before testing

was done by most other municipalities. Largely because of this proactive

approach to identifying the presence of PFAS, Thurston PUD was approved

for funding with principal loan forgiveness through the Washington State

Drinking Water State Revolving Fund to install treatment systems to

remove PFAS from the drinking water at water systems above EPA’s MCL.

The customers on these water systems have been notified by letter of the

detected PFAS and our plan to install treatment before the required date

of 2029.

In 2025, Assistant General Manager, Julie Parker successfully entered into PFAS cost recovery court cases against national PFAS polluters. As of October 22, 2025, the PUD is approved for an allocation of settlement funds from 3M, estimated at $1,121,660.35, with disbursements from 2025 to 2033. To date, the PUD has received $530,381.22 of the approved settlement funds. As of October 15, 2025, the PUD is approved for an allocation of settlement funds from DuPont, estimated at $116,208.05, with disbursements from 2025 to 2033. To date, the PUD has received $91,636.15 fo the approved settlement funds. The Board may use these monies to further pursue financial recovery for ongoing and future PFAS costs from the polluters. All claim settlement funds received will be used to pay for PFAS related expenses only.

Although the PUD has submitted claims to the

polluters to get them to pay for all pollution costs; so far, the

one-time claim settlements will not be enough to cover the projected

ongoing PFAS expenses. The PUD must plan and budget for the annual PFAS

O&M and Media Replacement costs, averaging $173,524. The annual cost to

cover these expenses over 20 years is $1.78 per month per Group A water

system customer.

Starting, January 1, 2026, all Group A water

system customers will be charged the new EPA/WA

State Emerging Contaminants Remediation Surcharge of $1.78. The

surcharge collections will be kept in the EPA/WA State Emerging

Contaminants Remediation Fund separate from the other District funds.

The surcharges collected will be used only to pay for PFAS expenses. If

polluters can be held accountable and sufficient funding is secured, the

surcharge monies would be used to either lower rates or refunded to

ratepayers.

The new monthly Emerging Contaminants Remediation

Surcharge of $1.78, billed to Group A water system customers only, is

necessary to ensure funding is available now and in the future for PFAS

on-going operations, maintenance, and media replacement costs.

If you do not know if you are on a Group A or Group B water system, you can contact Customer Service toll-free at (866) 357-8783 or by email at PUDCustomerService@thurstonpud.org to request this information.

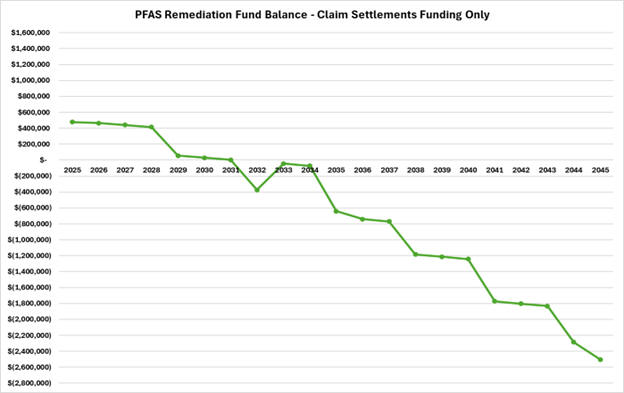

The table below depicts the PFAS

Remediation fund balance cannot pay for the PFAS general operations and

maintenance expenses and media replacement costs when using only the

one-time money received from claim settlements.

This graph below shows the estimated costs

for general Operations and Maintenance (O&M) expenses and media

replacement costs, the one-time money from claim settlements and the new

monthly EPA/WA State Emerging Contaminants Remediation Surcharge of

$1.78 billed to all Group A water system customers (approximately 9,100

customers).

The table below provides the

EPA/WA State Emerging Contaminants

Remediation fund balance on an annual basis for the general O&M expenses

and media replacement costs, and the annual fund balance if claim

settlements only paid for the expenses and if claim settlements and the

monthly new EPA/WA State Emerging Contaminants Remediation Surcharge

paid for the expenses. In column F, if the claim settlements only paid

for the PFAS expenses, the fund balance would not be able to pay for the

expenses in year 2032. However, in column G, if claim settlements and

the monthly new EPA/WA State Emerging Contaminants Remediation Surcharge

paid for the PFAS expenses there would be money to pay for the annual

expenses. Please note, this table does not include the estimated cost

for the treatment plant replacements. In 2027, when the treatment plants

are installed, District staff will review the treatment plant

replacements estimated costs and reassess the monthly surcharged needed

to pay for all PFAS expenses.

Audit Reports - WA State Auditor's Office